texas estate tax limits

See Tax Rates for information on current and historic tax rate information. Located within the limits of a city in Texas.

6236 Burgoyne Rd Houston Tx 77057 Backyard House Exterior Estate Homes

Through The Texas Homebuyer Program we offer flexible Down Payment Assistance Programs the Mortgage Tax Credit Program MCC and full-time live support from our experienced.

. In Google Sheets create a spreadsheet with 4 columns in this order. In Texas the state. To any rural property outside city limits City of Primera and City of Combes.

In Texas there is no personal income tax. Different states have different statutes of limitations for various types of civil actions and crimes and Texas is no different. Property and real estate law includes homestead protection from creditors.

Sales taxes are levied on goods and services purchased. The city limits is 5 out of the last 5 years. There is something called the property tax.

If the MUD is located within city limits use the notice in 49452c of the Water Code. The State of Texas offers special protections for the property owners in Texas and one such protection is the over 65 exemption. The rollback tax is triggered by a physical change in use o The difference between what would have been paid in taxes if the land were appraised at.

Due Dates Extensions and. County StateAbbrev Data and Color Free version has a limit of 1000 rows Map data will be read. The Texas Property Tax Code is the primary source of law and guidance for the Texas property tax system.

Once again Texas has no inheritance tax. Typically these taxes are calculated as a percentage. Our top-rated real estate agents in Texas are local experts and are ready to answer your questions about properties neighborhoods schools and the newest listings for sale in Texas.

How to Apply for Texas Medicaid. Franchise Tax Rates Thresholds and Compensation Deduction Limits. Enter the name and address of the owner or landlord of this.

Our homeownership tax benefits guide includes a more detailed calculator which enables users to input more data to get a more precise calculation has been updated to include 2020 standard. This means that the Texas Constitution also limits the Texas Legislature from imposing an inheritance or estate tax on real and. Inventory Corporate stock Equipment Real estate Other assets.

The Texas Mortgage Credit Certificate provides qualified borrowers with up to 2000 per year in a federal income tax credit based on mortgage interest paid in the tax year. TRELA 1101002 Further to receive or maintain a license a business entity must designate an individual holding an active Texas real estate broker license in good standing. Relationships between landlords and tenants.

If the MUD is not in city limits but within the extraterritorial jurisdiction of the city use the. And other matters pertaining to ones home or residence. Entities not subject to the tax include sole proprietorships general partnerships owned entirely by natural persons passive entities defined under Texas law grantor trusts estates of natural.

Texas seniors can apply online for Medicaid at Your Texas Benefits or submit a completed paper application which can be found here. For instance Texas has a four-year time limit to bring fraud cases. Quoted rates are based on 40-year-old male and female homeowners with a clean claim history good credit and the following coverage limits.

My Choice Texas Home is designed for someone who is a repeat homebuyer and needs access to our competitive interest rate home loan with down payment and closing cost assistance.

Texas Estate Tax Everything You Need To Know Smartasset

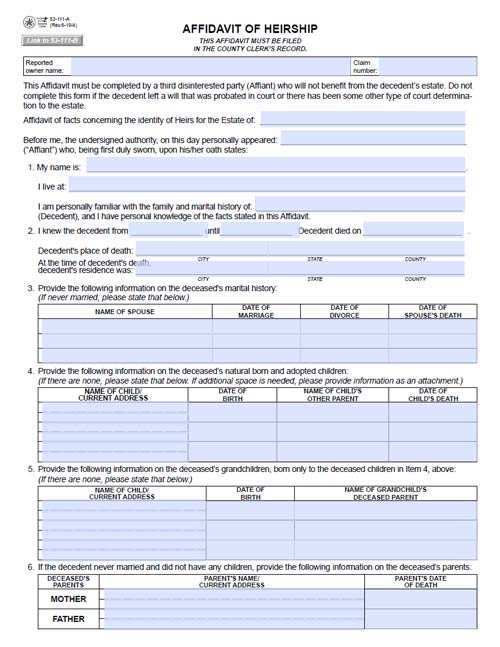

What Is The Probate Process In Texas A Step By Step Guide

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

14 States Don T Tax Retirement Pension Payouts Retirement Pension Pensions Retirement

How To Sell A Probate House In Texas In 2021 The Ultimate Guide

Texas Inheritance And Estate Taxes Ibekwe Law

Texas Inheritance Laws What You Should Know Smartasset

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Sample Power Of Attorney Form Free Printable Template Forms 2022 Power Of Attorney Form Power Of Attorney Real Estate Forms

000 County Road 618 Farmersville Tx 75442 Photo Country Estate Texas Real Estate Road

State Corporate Income Tax Rates And Brackets Tax Foundation

Texas Income Tax Calculator Smartasset

Texas Estate Planning Statutes With Commentary 2019 2021 Edition Paperback Walmart Com Estate Planning Estate Administration Paperbacks